Diagramming System Design: Rate Limiters

All production-grade services rely on rate limiters - when a user may post at most five articles...

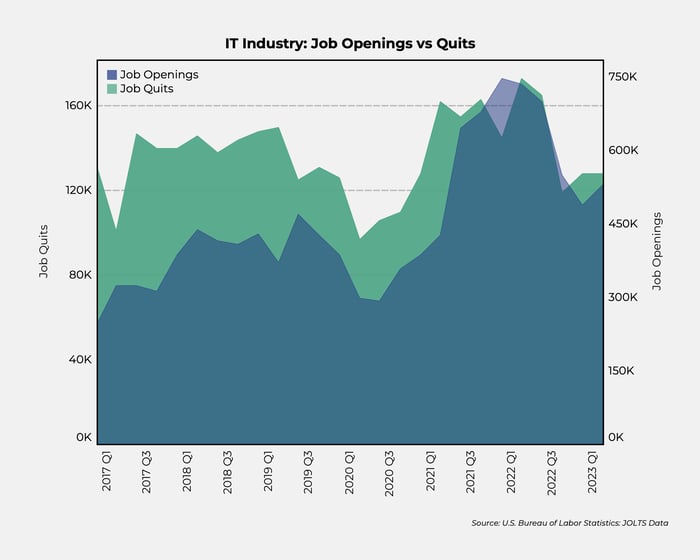

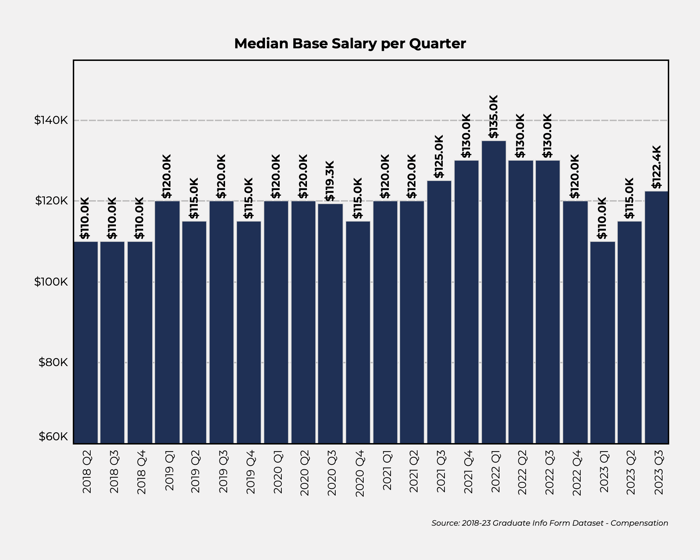

Employment trends in the Information Technology (IT)1 sector offer rich insights when juxtaposed with the evolving trends from Codesmith’s Software Engineering Immersive data.2 We delved into the U.S. Bureau of Labor Statistics: Job Openings and Labor Turnover Survey (JOLTS)3 data and the median salaries of graduate data to uncover the nuanced interplay between salary and industry employment trends.

Stabilization in 2022-2023: Post the explosive growth, both job openings and resignations began to stabilize, with resignations reverting to pre-pandemic levels and openings settling slightly above their pre-pandemic numbers.

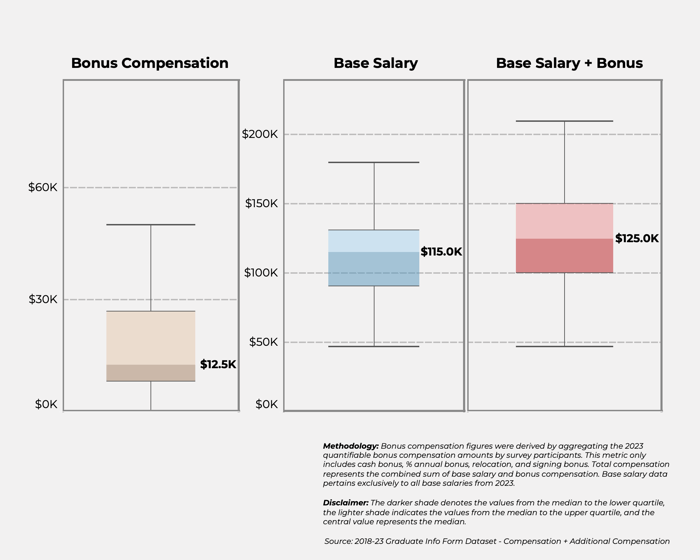

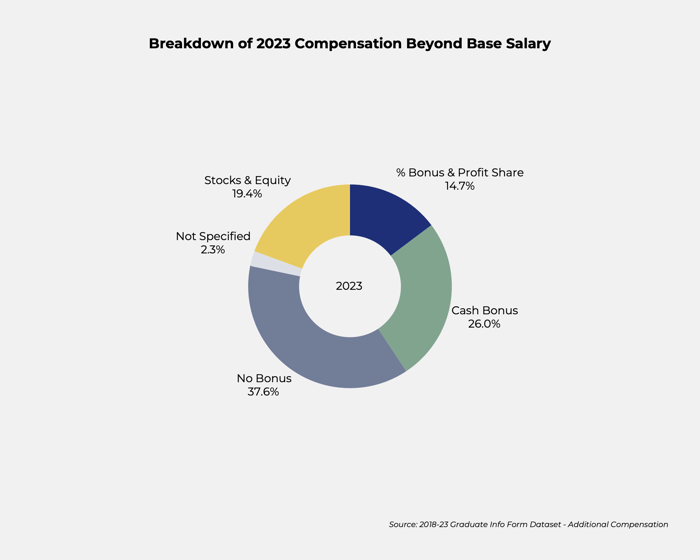

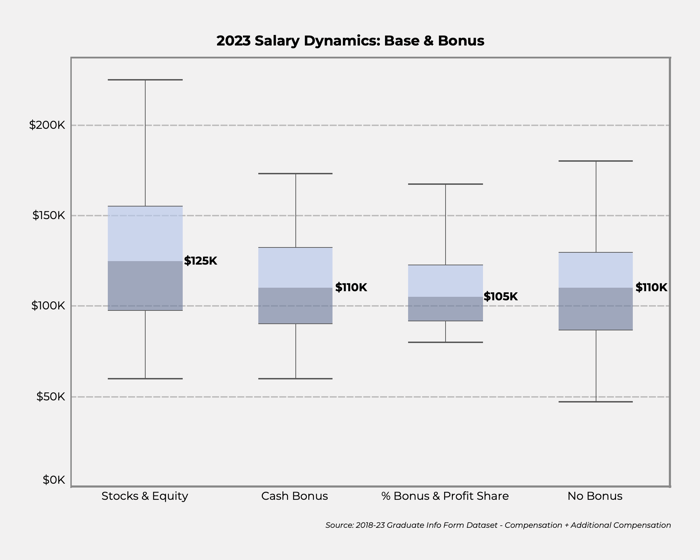

With the backdrop of 2023’s market stabilization, we dissected the 2023 median values associated with bonus compensation and base salary to derive key insights about current compensation dynamics. Bonus compensation was subjected to rigorous scrutiny. It is important to explain that while elements such as stock options, equity, and RSUs have been methodically excluded due to their intricate valuation complexities, our methodology was anchored in the aggregation of quantifiable bonus figures. Our observations for 2023 indicate a median base salary of $115K. However, it’s in the realm of bonuses and additional compensation where the landscape becomes multifaceted:

The data presents a compelling narrative of the tech industry's resilience and adaptability. The correlation between IT job dynamics and Codesmith graduate salaries is noteworthy. The post-pandemic surge in IT job openings directly correlated with an increased demand for skilled professionals, resulting in higher salaries in the market. As the IT industry navigates a phase of salary normalization, a data-centric examination is essential to discern overarching patterns.

For tech professionals and industry stakeholders, these trends underscore the importance of agility and continuous upskilling. In an industry marked by rapid technological advancements and external disruptions, the ability to adapt and evolve remains paramount, especially as job growth predictions for the IT sector remain strong.6 In the 2023 compensation analysis, we observed that many companies are using bonus and other types of compensation beyond base salary to attract and incentivize top talent and to adapt to these dynamic conditions.

We received raw data2 from Codesmith to enable this study. We analyzed data based on ‘date of offer’ rather than ‘date of graduation’ and included all first offers received, which was more pertinent to our industry analysis. Council for Integrity of Results Reporting is expected to publish Codesmith outcomes results in Fall 2023.

1 “Industries at a Glance: Information: NAICS 51,” U.S. Bureau of Labor Statistics, https://www.bls.gov/iag/tgs/iag51.htm.

2 The data analyzed was from a survey of graduates who received their first offers post-Software Engineering Immersive. The survey tracked graduates with offers from 2018 - 2023. The sample size was 1830 graduates. For the 2023 compensation analysis section, the sample size was 259 responses.

3 “Job Openings and Labor Turnover Survey (JOLTS),” U.S. Bureau of Labor Statistics, https://www.bls.gov/jlt/.

4 Elissa El Khawli, Anita C. Keller, Maximilian Agostini, Ben Gützkow, Jannis Kreienkamp, N. Pontus Leander, Susanne Scheibe, The rise and fall of job insecurity during a pandemic: The role of habitual coping, Journal of Vocational Behavior, Volume 139, 2022, 103792, ISSN 0001-8791, https://doi.org/10.1016/j.jvb.2022.103792.

5 Parker, Kim and Juliana Menasce Horowitz, “Majority of workers who quit a job in 2021 cite low pay, no opportunities for advancement, feeling disrespected,” Pew Research Center, March 9, 2022.

6 “Computer and Information Technology Occupations,” U.S. Bureau of Labor Statistics, Last Modified September 6, 2023.

All production-grade services rely on rate limiters - when a user may post at most five articles...

Shorthand links are everywhere. URL shorteners have gained in popularity over the years, from...

Introduction ChatGPT reached one million users in the first five days of product release. Needless...