The tech landscape, always in flux, has seen pronounced shifts in the wake of the global pandemic. By examining the median salaries of Codesmith Software Engineering Immersive graduates1 based on job titles and industries, both pre-2020 and post-2020, we can discern the evolving priorities and economic demands of the tech sector.

Job Titles - A Deep Dive

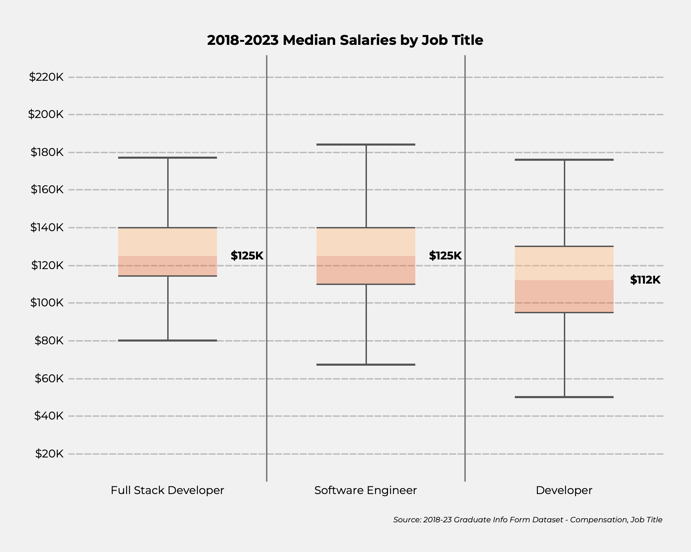

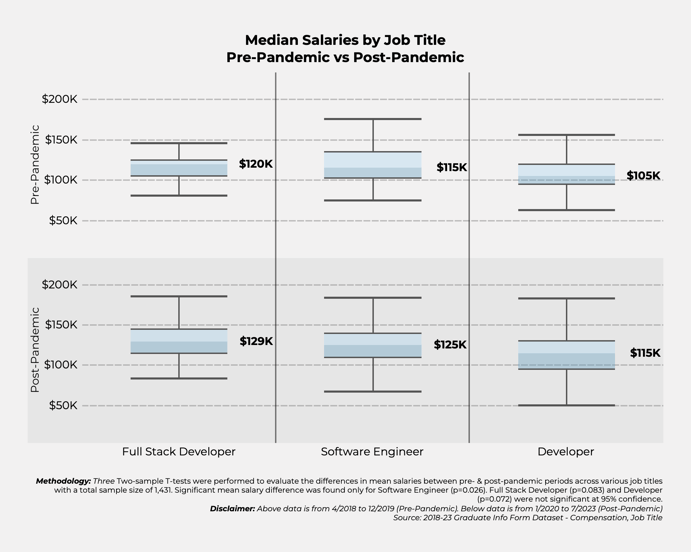

- Full Stack Developers: The role of a Full Stack Developer, encompassing both front-end and back-end responsibilities, has seen a significant surge in median salary post-pandemic, with an increase from $120K pre-pandemic to $129K post-pandemic, a 7.5% rise. This suggests that as companies pivoted to digital solutions during the pandemic, the demand for professionals who could handle end-to-end development grew. In their 2022 State of Software Engineers report,2 Hired found that full stack developers were the most in-demand role on their platform. Hired’s report found that the aggressive hiring of full stack engineers in 2021 led to a notable increase of 2.1% in interview requests for these professionals compared to 2020. This marks a significant shift in hiring trends as companies sought to bolster their engineering teams' efficiency.

- Software Engineers: While the title 'Software Engineer' often overlaps with 'Full Stack,' the median salary for graduates with this title remained stable at $115K pre-pandemic and saw a significant 8.7% increase post-pandemic to $125K.

- Developers: General Software Developers, encompassing a broader range of tech roles, witnessed a 9.5% increase in median salary for graduates, moving from $105K pre-pandemic to $115K post-pandemic. This suggests that while specialized roles saw higher demand, there was also a consistent need for general software development skills.

Industry Insights

- Finance & Fintech: The financial sector emerges as the highest paying among all the industries examined from 2018-2023, boasting a median graduate salary of $130K, according to the graduate data. Historically a lucrative sector, Finance & Fintech saw a 4.8% increase in median salary for graduates post-pandemic, moving from $125K to $131K. The pandemic accelerated the adoption of digital financial solutions. Statista's global forecast for the digital payments market anticipates an annual growth rate of 11.8%.3 By 2027, digital payments are expected to amount to $14.78 trillion, while the total transaction value for digital payments is estimated to hit $9.46 trillion by 2023.4 This further emphasizes the growing demand for tech professionals in this sector.

- Software & Tech: Representing the core of the tech industry, this sector saw a significant 13.6% surge in median salaries for graduates, from $110K pre-pandemic to $125K post-pandemic. The pandemic underscored the importance of robust software solutions, leading to heightened demand for professionals in this domain. In fact, a study done by CompTIA5 shows that the unemployment rate for tech occupations remained at 1.5% in July 2021 and stayed below 2.5% until July 2023, reaching near historical lows.

- Retail & E-commerce: With physical stores facing restrictions, the e-commerce boom was inevitable. The sector's median salary for graduates saw a 9.1% increase, from $110K pre-pandemic to $120K post-pandemic, reflecting the industry's pivot to online shopping. In 2022, digitalization in advanced economies surged by an average of 6% due to the COVID-19 pandemic, compelling businesses and consumers to embrace digital technologies for continued operation, as per a recent IMF report.6

- Media & Advertisements: As consumption patterns shifted online, the media and marketing sectors adapted swiftly. Graduates’ median salary in this industry saw a significant 14.5% rise, from $110K pre-pandemic to $126K post-pandemic, indicating the growing importance of digital marketing strategies. This group experienced the highest percentage growth among all the groups studied. A McKinsey7 study highlighted that the pandemic caused notable channel switching and brand loyalty disruption, with 75% of consumers trying new shopping behaviors. Particularly, 39% of younger consumers shifted to new brands, driven by value alignment. This shift could have contributed to the growth of the media and advertising industry as brands possibly intensified their efforts to attract and retain customers.

- Health: Interestingly, while the health sector was at the pandemic's forefront, the median salary for graduates saw a decrease of 4%, from $125K pre-pandemic to $120K post-pandemic.

Conclusion

The data suggests an interesting correlation between the pandemic-induced digital shift and the rise in median salaries for Codesmith graduates across most tech roles and sectors. Full Stack roles, characterized by their wide-ranging skill sets, have demonstrated higher earning potential for graduates compared to other job titles.

Sector-wise, Finance & Fintech was the highest paying industry while Media & Advertisements led the charge in growth with a 14.5% surge in median salaries for Codesmith graduates, underscoring the sector's central role during the pandemic. However, the decline in Health salaries serves as a reminder that even in a digital-first world, sector-specific dynamics play a crucial role.

In essence, the pandemic, while disruptive, also catalyzed significant growth in the tech sector. The Bureau of Labor Statistics8 anticipates substantial job growth of 25% for software developers from 2022-2032. In contrast, the projected average growth for all occupations during the same period stands at 3%. This notable variance provides analytical evidence of the transition businesses have made toward integrating digital solutions in recent times. For Codesmith graduates and tech professionals, understanding these shifts is not just beneficial—it's essential. As the world moves towards a post-pandemic era, these trends will shape the industry's trajectory, offering both challenges and opportunities.

1 The data analyzed was from a survey of graduates who received their first offers post-Software Engineering Immersive. The survey tracked graduates with offers from 2018 - 2023. The sample size was 1830 graduates.

2 “2022 State of Software Engineers,” Hired, https://hired.com/2022-state-of-software-engineers/.

3 “Digital Payments - Worldwide,” Statista, https://www.statista.com/outlook/dmo/fintech/digital-payments/worldwide.

4 Ibid.

5 “Tech Jobs Report,” CompTIA, https://www.comptia.org/content/tech-jobs-report.

6 Alexander Copestake, Julia Estefania-Flores, and Davide Furceri, “Digitalization and Resilience,” International Monetary Fund, October 28, 2022, https://www.imf.org/en/Publications/WP/Issues/2022/10/28/Digitalization-and-Resilience-525207.

7 “Emerging consumer trends in a post COVID 19 world,” McKinsey & Company, https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/emerging-consumer-trends-in-a-post-covid-19-world.

8 “Occupational Outlook Handbook: Software Developers, Quality Assurance Analysts, and Testers,” U.S. Bureau of Labor Statistics, September 6, 2023, https://www.bls.gov/OOH/computer-and-information-technology/software-developers.htm.